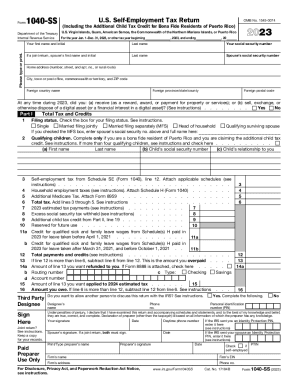

What is a 1040-SS tax form?

1040 SS is also known as the U.S. Self-Employment Tax Return form. It is used to file self-employment earnings, calculate the amount of owed taxes (if required) by citizens who live in certain territories of the United States, pay Medicare and Social Security taxes, and claim certain credits.

Who must file Form 1040-SS 2024?

1040 SS is required for self-employed U.S. taxpayers who live in particular territories and are not required to file the 1040 form. It is applicable for the citizens of the United States that reside in American Samoa, the Commonwealth of the Northern Mariana Island, Guam, the Commonwealth of Puerto Rico, and the U.S. Virgin Islands.

If you are a self-employed filer in Puerto Rico, you may file 1040-PR instead.

What information do you need when you file 1040-SS?

You must provide your name, Social Security Number (and your spouse’s name and SSN), and address.

Next, prepare information considering the following:

- Total tax and credits

- Profit or Loss from Farming

- Profit or Loss from Business (Sole Proprietorship)

- Self-Employment Tax

- Optional Methods to Figure Net Earnings

How do I fill out Form 1040-SS in 2025?

The most convenient way to fill out 1040-SS in 2025 is to use pdfFiller:

- Click Get Form and wait for the service to establish a secure connection.

- Turn on the Wizard mode to get additional tips on filling out the template.

- Start entering your data into fillable (orange) fields.

- Use the official instructions by the IRS if you have any concerns.

- Sign the document using the Sign tool.

- Click Done to save changes, close the editor, and access the exporting menu where you can download a PDF or send it by email.

Do other forms accompany Form 1040-SS?

1040-SS requires you to attach Forms 8959 and 8885. If needed, you may choose to attach Schedule H (1040) and 8888. To learn more, use the official instruction on how to file 1040-SS by the Internal Revenue Service to review a complete list of required forms.

When is Form 1040-SS due?

Usually, the due date for Form 1040 SS is April 15.

In 2022, the due date is April 18 because of the Emancipation Day holiday in the District of Columbia. For filers who live in Maine or Massachusetts, the due date is April 19 because of the Patriots' Day holiday in those states.

Where do I send Form 1040-SS?

You can file 1040 SS online. If you want to submit it by mail, choose the correct mailing address based on whether you need to enclose payment or not.

If you need to include payment, please send it to the Internal Revenue Service (P.O. Box 1303, Charlotte, NC 28201-1303, USA). If you do not, send the filled-out document to the Department of the Treasury of Internal Revenue Service (Austin, Texas 73301-0215).